01 Oct 2014

By Belle

Apps to track your finances

I've covered apps to track your sleep, your habits, your media and your time on the Exist blog before. Today I wanted to look at apps to help you keep track of your finances.

Of course, you could simply use your own bank's app to keep track of your income and spending habits, but if you have accounts across several banks or you want to track your cash expenses, one of these apps might be more suitable.

Spendee

iOS, Android

Spendee is a pretty, cross-platform app that lets you manually add expenses and categorise them. It has some simple graphs built-in and offers iCloud backup and exporting options.

Cost

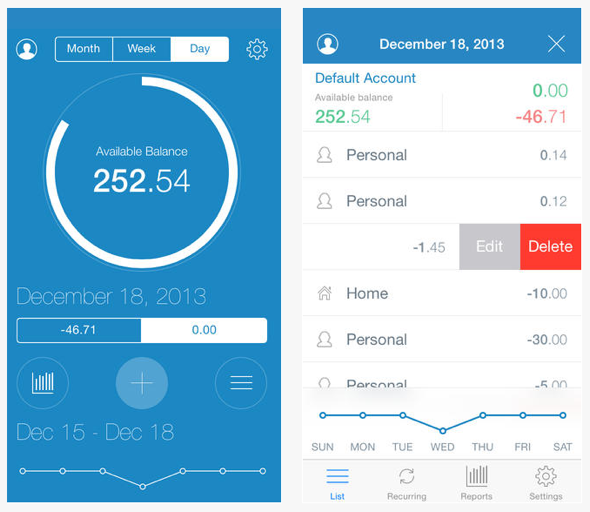

iOS

Cost is very simple. It lets you track your income and expenses manually, but also shows your current balance. If you want to keep an eye on how much money you have left without setting a strict budget, Cost is a great pick. It also has iCloud syncing and exporting options.

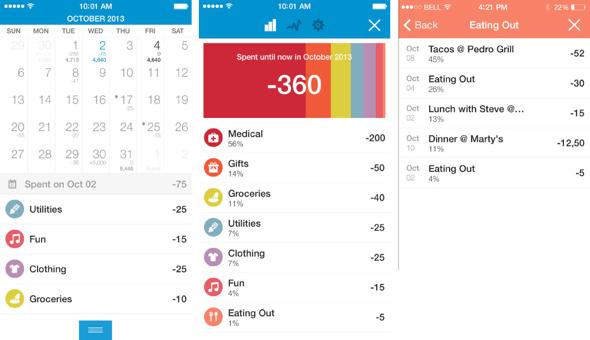

Daily Cost

iOS

Daily Cost boasts a stack of different currency and language options, has different themes you can apply, and lets you pull down to add a new expense, making it super fast. You can also export your data as a CSV.

Wally

iOS

Wally lets you tag locations with your expenses, and has both categories and contexts for categorising your spending. Wally also lets you save photos of receipts to store for future reference, and (though I've found it to be unreliable) Wally can scan your receipt photos to automatically grab the relevant details of your purchase.

Dollarbird

iOS, Android

Dollarbird takes a calendar approach to tracking finances. Built-in graphs show how your balance has changed over time and a calendar view shows your expenses and balance per day.

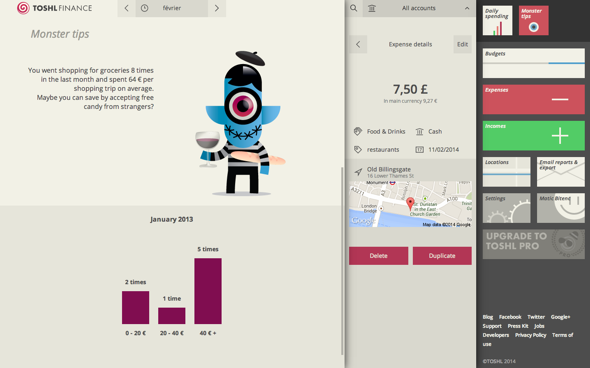

Toshl

Web, iOS, Android, Symbian, Windows Phone

Toshl uses tags to categorise your spending, and includes bill reminders, graphs of your data, and budgeting. It's probably the most cross-platform option available, and has flexible exporting features.

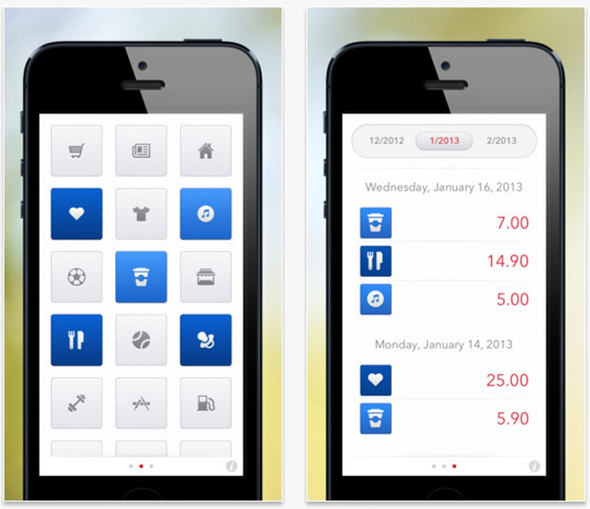

Next

iOS, Mac

One of the few apps that includes a desktop version is Next. It's another very simple manual tracking app that includes categories for expenses, built-in graphs, exporting and iCloud sync.

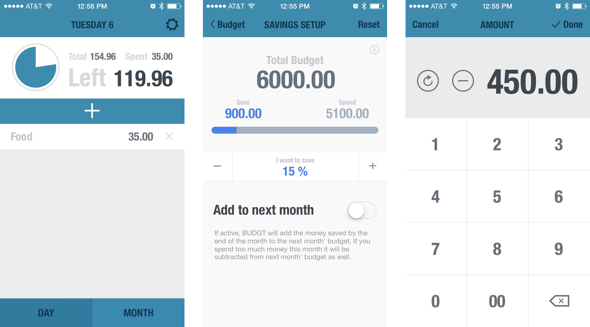

BUDGT

iOS

BUDGT is aimed at students and other users with small incomes. The app creates a budget for you each day based on how much you've spent in the month so far, and lets you add recurring expenses and a savings goal.

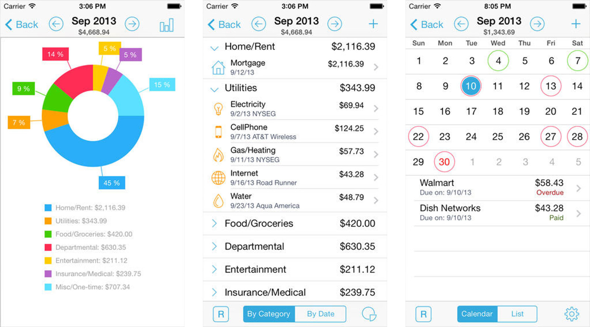

HomeBudget

iOS, Android, Mac, Windows

If your household needs a way to keep track of income and expenses together, HomeBudget could do the trick. It's available on various platforms and includes budgeting features, graphs, and income and expense tracking.

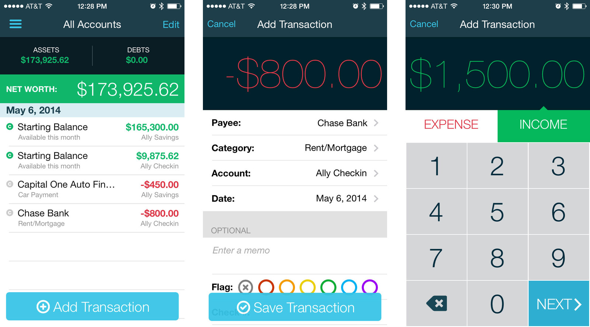

You Need A Budget

iOS, Android, Windows, Mac

You Need A Budget is more in-depth budgeting and finance tracking software. It's available across various platforms and lets you add notes about your expenses, split transactions, and schedule bill payments.

Note: There are some popular finance apps that connect to your bank directly so you don't have to manually input your income and expenses. While this sounds really convenient, banks are a bit behind the times and haven't opened up a secure way for developers to access our transaction data. In the meantime, some developers have decided it's okay to ask you for your bank account login details to download your transaction data.

We don't think that's okay. Finding a workaround that puts users at a security risk is a huge turnoff for us, so I haven't included those apps in the roundup, even though you can use some of them without connecting your bank account.

Exist helps you improve what matters to you. Sign up for a 14-day free trial.

Image credits: Redmond Pie, Cost, Apple user, iMore, TheAppleGoogle, Blogbranch, The Next Web, MacMagazine